Data-driven and tailored approach to

Transparency

"Claim ID embodies transparency and openness, increasing trust through clear communication and real-time data analysis. We provide clients with a clear view of their loss adjustment processes and encourage open dialogue so they can continuously improve. Our comprehensive reports help clients make informed decisions and strengthen the credibility and reliability of their business.

Innovativeness

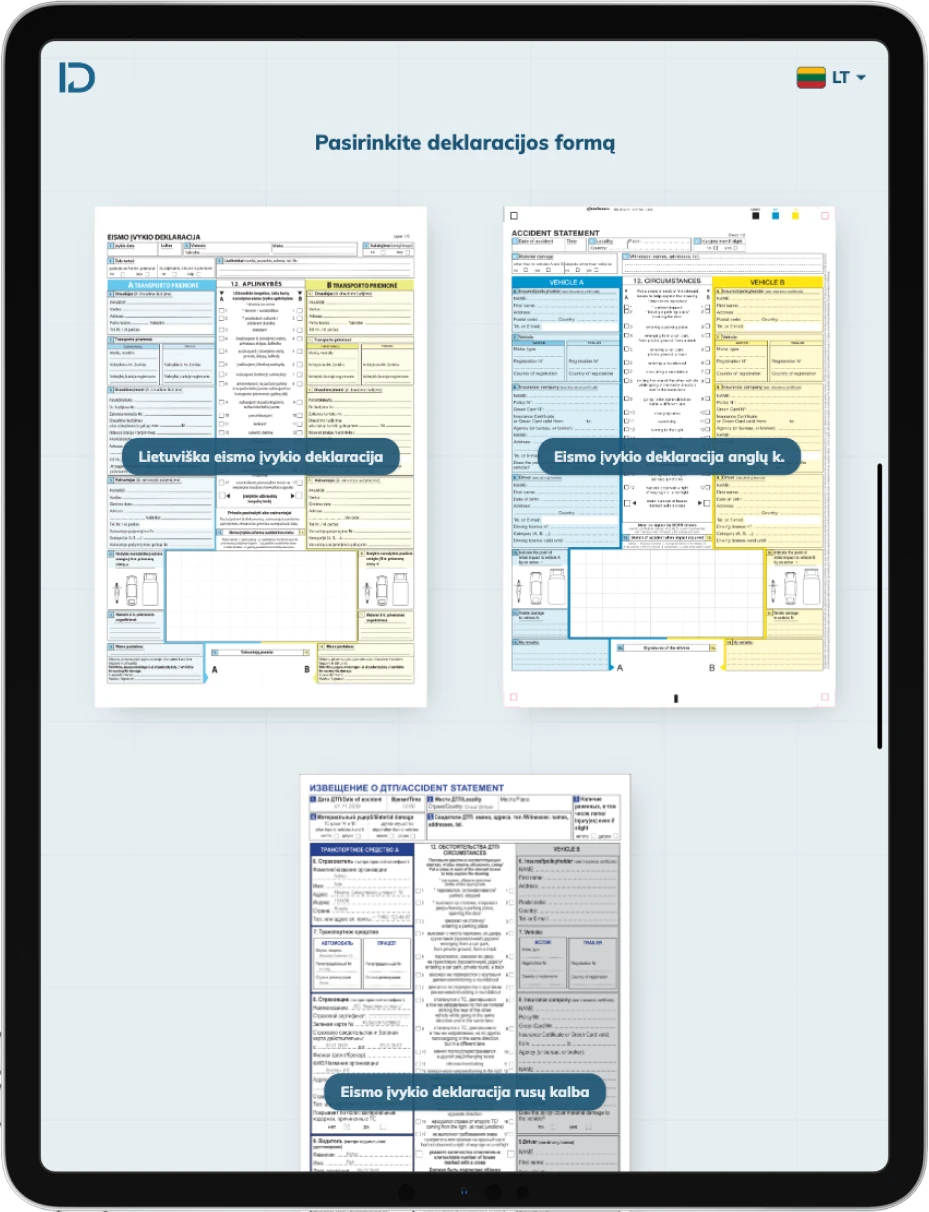

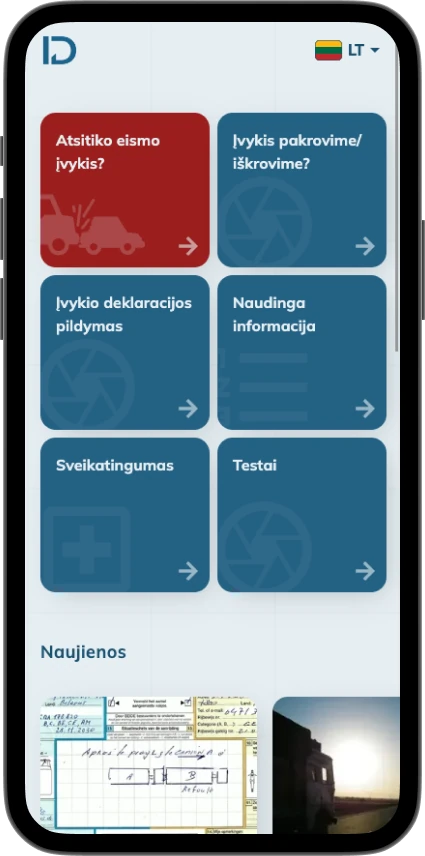

"Claim ID" fosters a culture of relentless innovation, introducing advanced solutions for loss adjusting, risk management and data analytics. Our mobile apps and real-time loss administration system are revolutionising risk management. We anticipate market changes and always strive to not only meet but also exceed our clients' expectations with our innovative solutions.

Individuality

Recognising the unique needs of each client, Claim ID offers a personalised approach. Our mobile app, claims management system and periodic analyses are carefully designed to meet the individual needs and objectives of each client. Our specialised training services are tailored to the unique requirements of our employees, contributing significantly to our clients' competitiveness and confidence in navigating the risk environment.

Data

Businesses are constantly exposed to the risk of loss under conditions of uncertainty. Our approach to claims management is data-driven. Claim ID develops solutions and advises clients on the collection, storage and evaluation of the necessary data. Our tools make it possible to find event information and regulatory status in real time. Data collected by individual indicators becomes meaningful insights thanks to our analysis. Data is the foundation of every company's long-term risk management strategy and success.

Analytics

Enterprise data analysis turns the information gathered into actionable insights. Claim ID identifies risks to the client's business, assesses changes and trends. Periodic analyses are prepared based on the client's individual objectives and specific market indicators. Proper and timely assessment of adverse trends reduces losses and the cost of adjusting them, which is why Claim ID is actively involved in the client's overall risk management process. Our recommendations cover a wide range of solutions from technical measures to prevention. Employee training, process audits and cost analysis help our clients reduce risks and increase competitiveness.

Representation

An efficient claims process, the necessary data and timely risk assessment enable maximum results in claims disputes. Claim ID represents clients in third-party loss recovery and indemnity cases across Europe. A network of partners, eskpertises, investigations and legal advice are essential in representing the client's ineteres.

Training

We provide specialised training services tailored to the unique needs of our employees. Providing the necessary knowledge and skills can help you reduce the negative impact of unforeseen events, make timely and appropriate decisions and manage losses. We develop tools to help employees take the necessary actions in real time at the scene of an event, and to ensure a seamless process standard for the company.

Why We Stand Out?

- A customised mobile app to help staff get relevant information and instructions in case of an incident.

- A training programme for employees covering lifestyle and professional skills.

- A claims management system tailored to the client's individual needs, allowing the client to see the process in real time.

- Analysis of loss identification, adjustment costs and recommendations for loss mitigation.

- Legal and expert services in Germany.